Introduction

In the context of the Dach2US initiative to create a Transatlantic Accelerator leveraging on our founders ecosystems in the EU, UAE and USA our team was asked to conduct a preseed analysis to evaluate the potential of an AI based planning, controlling, management tool for SME’s.

The 30minCEO© not only should analyse p&l data and benchmark them against a corporation’s internal planning but also compare those with industry standards by regions, markets and segments.

Furthermore this AI-tool also acts as an instrument to deliver a continuous screening mechanism as well as an alert system that provides in consequence automated management guidance in a 360 perspective regarding all organizational dimensions from strategy to inbound, transformation and outbound activities and therefore to enable ownership and management to efficiently set business administration actions.

The idea was 1st conceptualized in 2020 together with a long time friend and CFO of one of the world largest diversified technology companies centered on innovation based in the USA. Thereafter in 2021 the proposition was formalized by him as a participant of the Innovation-Operative© course, class of March 2021, presenting it as his Workmap, the final paper before graduating as IO©.

The IO-program© was created together with high profile universities and organizations like the Future Directions Commitee of the IEEE, the University of Berkley California, USA and the University of Trento, Italy. Many top experts in the field of Innovation made guest appearances, like executives from Bosch, Google and scientific experts, CEO’s and senior practitioners from around the world.

General challenges facing accelerators

For more then 10 years connected groups and I work in the field of Technologie- and Business-Model-Innovation and we were involved in more than 40 start- and scaleup projects between Austria, Germany, Italy, LatAm and the USA.

Our observation was that in many cases preseed decision processes are lengthy due to the time consuming evaluation and selection procedures in place. In many cases accelerators retention rates are also longer than 3 years because often the maturity of the technology and/or the underlying business model is low. Due to missing snap competitive analysis’ and not or poorly performned fast market tests, investments often are not producing the envisioned performance within the promised time frames.

A Mc Kinsey study confirms our findings and the challenges faced like the selection & acceleration mismatch.

Accelerators sometimes accept too many unsuitable participants, diluting the effectiveness of support. Founders may be pushed into accelerators before they’re ready, while true incubator-level preparation is either absent or inadequate.

This has led to a certain disillusionment across the globe and seed, as well as VC money becoming scarce.

Building a business plan and drawing up financial forecasts is the Short Program. The prevalidation of the proposition is the Free Skate!

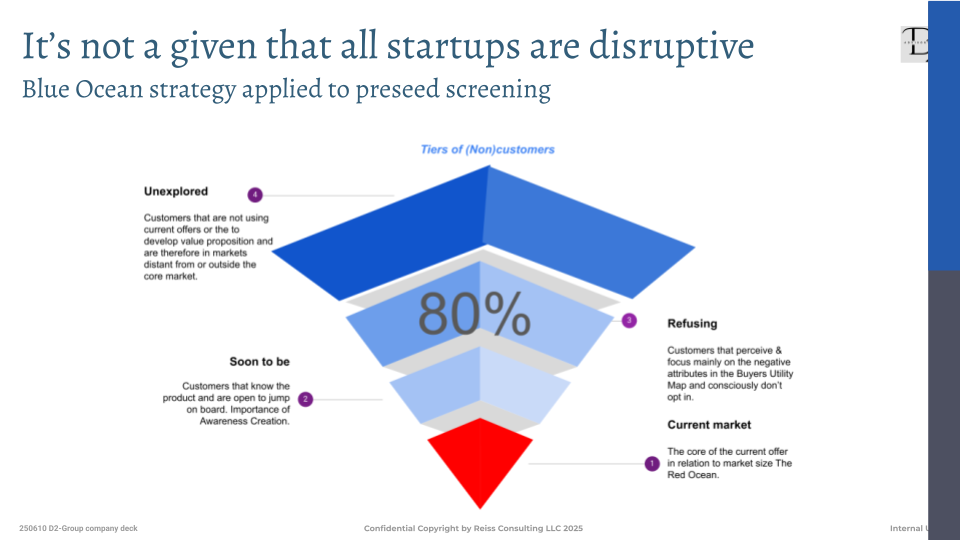

Blue Ocean Strategy and VGCG-360-Analysis© in preseed and VC

The preseed Blue

Since 2008 I’m an afascinado of the Blue Ocean Strategy developed by the professors Renée Mauborgne und W. Chan Kim at the INSEAD where I had the opportunity to directly collaborate with leading contributors to the bestselling book.

Because one of the central premises of the Blue Ocean method is the finding of the uncontested market space and the design of strategies activating such potential, I applied the tool set provided by the Blue Ocean technique to a preseed analysis for disruptive business ideas, start- and scaleups.

One basic assumption to do so was that if an idea, a technology and/or a related business model is supposed to be (ultra)scalable and to fit the performance requirements of an early stage investor as well as VC’s it must necessarily operate in a Blue Ocean?

If 80% of the target market of a new business model based on disruptive technology remains after our IO-Preseed-Analysis© a Blue Ocean then we suppose that the probability to meet incubation parameters is high and most likely to satisfy investors expectations.

Therefore we recommend a preseed investment and promote the concept to be incubated to MVP and POC maturity.

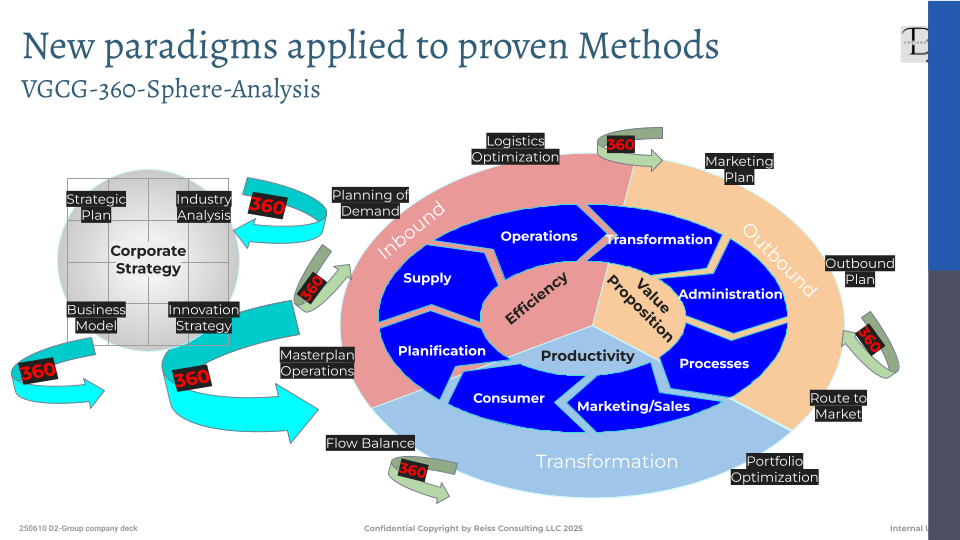

The VGCG-360-Analysis© in Preseed and VC

So after a 1st go there is a green light to apply a 2nd set of screening practices, the VGCG-360-Analysis© developed by Castellano-Ruiz, Subieta-Encinas, Trigo-Ruiz and Reiss in 2016.

At the time I was living in Santa Cruz de la Sierra, BOL and our advisory Value-Gneration-Consulting-Group (VGCG) developed a specific analysis procedure extending Micheal Porter’s value chain approach.

The VGCG-Sphere-Analysis-360© not only includes the strategy layer of an organization’s workings but also puts its activities into a 3-dimensional space so the different spheres such as inbound, transformation and outbound are interconnected.

When applying the VGCG-Analysis© in a preeseed screening we cross-check each and every aspect of the 360 with the proposed business idea’s layout and plan while asking the founders to profoundly answer challenging inquiries in regards to all corporate dimensions.

E.g. one could pose the question: How much do customer service costs grow in relation to the growth in clients, especially when the latter is exponential? Are the structural capacities of the business model fostered to guarantee client satisfaction and are we within the financial feasibility? So in this example we see how the customer service part (transformation sphere) interconnects relevantly with outbound and inbound activities as well as the underlying expansion strategy.

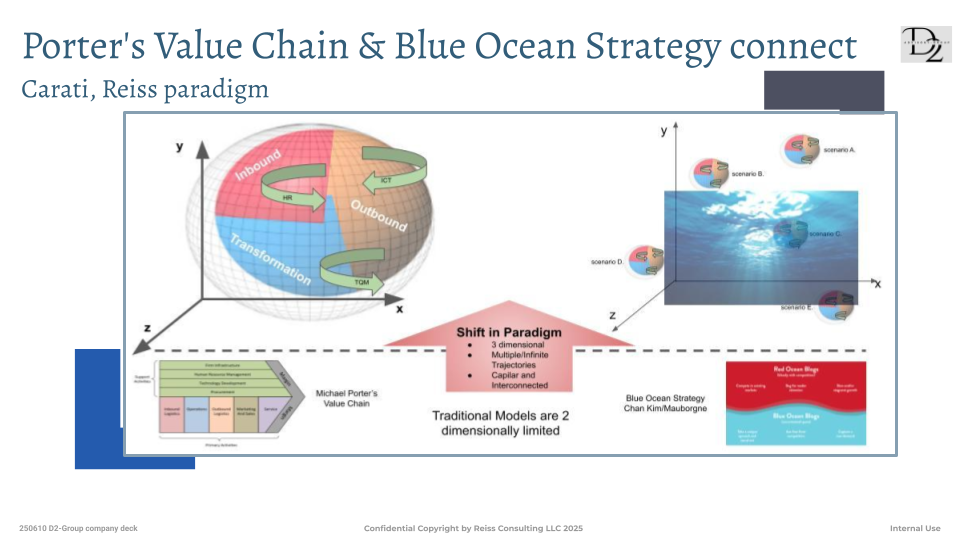

Change Trajectory

If the combined analysis based on the Blue-Ocean-in-Seed© and the VGCG-360© show potential to improve the value proposition of a start- or scaleup, then we rely on a 3rd proprietary methodology that we call The-Deep-Blue©. This tool that was developed based on the Carati-Reiss-Theorem© puts business models and companies into a 3 dimensional space. This allows what we call the trajectorial thinking.

Lat’s say an innovative business model is the combined application of an ICT tool development that supports the structured elaboration of corporate data, its storing in blockchain, helps structuring tasks, schedules and includes worksheets and reports but also leverages on the Data Science that can be applied to such information streams. And lets suppose there are already existing applications available in the market covering the basic software.

Now the question is: Is it really necessary to create an elaboration tool or is it advisable to rely for that part on existing companies while focusing on the data layer?

In the context of The-Deep-Blue© this would mean to move the business concept from one trajectory to another, in this example with data science focus only. Once the idea has moved on a new trajectory within our analytical model, another Blue-Ocean-in-Seed© and VGCG-360© is conducted until the value proposition is optimized or finally thrown out.

The 30minCEO case

In the case of the 30minCEO© the Blue-Ocean-in-Seed showed a relevant high competitive environment in regards to tools that are posed to data collection, structuring and storing as well as the support in operational processes. Also in this dimension the startup was facing a Red Ocean we considered the business idea valid but only due to the founders in-depth personal ecosystem in the industry that would be used as the accelerated launch pad.

The VCCG-360© returned strong, showing that the founders had done their homework in regards to most aspects of the spheres related to the to be business.

As a direct consequence the fund raising process took less then 3 weeks and USD 1 Mio in preseed money was invested by corner investors.

Summary and takeaways

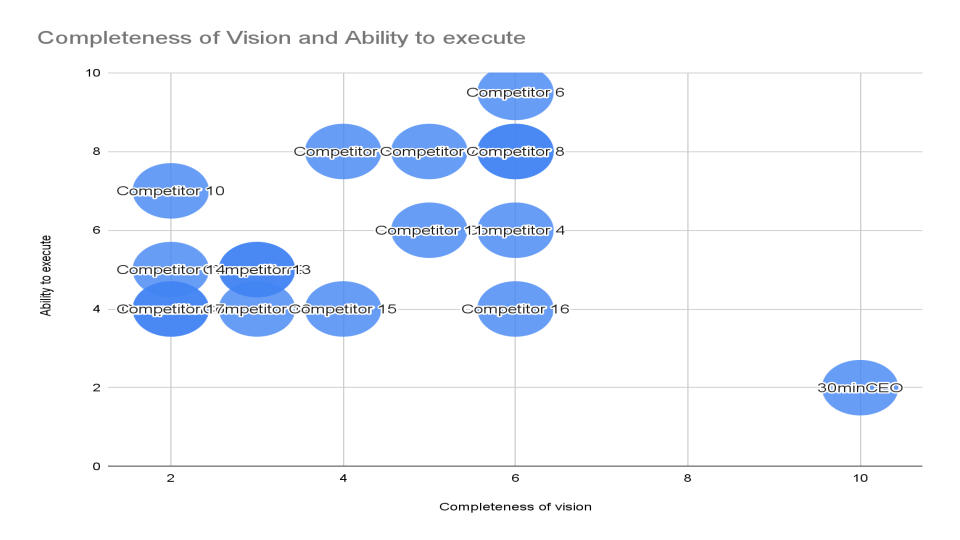

Parallel to the applied methodologies Blue-Ocean-in-preseed©, VGCG-360©, The-Deep-Blue© and the Carati-Reiss-Theorem© our Dach2US team made extensive use of AI applications deploying it on the data collection side and in the competitive analysis leading to the Gartner Magic Quadrant probe.

While usually the validation of a new business-idea and -model can take up to 3 month, we were able to conduct the investigation within 10 days. The fast track appoval not only reduced the time to action in a very impactful way but also increased the certainty for the 1st moving investors that the startup would be a great success and meet their rate of return expectations.

Furthermore we created a higher level of transperency compared to traditional models, reduced the time to funding and positioned the investment on an optimized trajectory.

Dr. Torsten Reiss is co-founder of Dach2US. He graduated from the Universa’ degli study di Bologna, the oldest University in the world and after he started his career as Investment Banker for Deutsche Bank. Later he worked for many years in Strategy- & Management consulting in countries such as Germany, Italy, Poland, the UK and several countries in LatAm before returning to deliver concepts for the PE and M&A industry.

In recent years TR gained in-depth insights into the world of Technology- & Business Model Innovation working with start- & scaleups. He has a strong academic record teaching as guest and working on case studies with some of the top 10 MBA schools worldwide and to end up developing a MiniMBA together with some renowned professores from Universties like UC Berkeley, MIT and IEEE.

As entrepreneur and executive TR was involved in more then 40 company launches and Internationalization projects on 3 continents.

Leave a Reply

You must be logged in to post a comment.