Background

In September 2024 a long time friend and business partner Michael Hofmayer from Vienna, Austria & I, while I was living in Santa Cruz de la Sierra, Bolivia just returning from a business tour through Chicago, IL, Yankton, SD & Ft. Myers, FL had a chat about my background in the US and Internationally.

Michael pointed out that with so many years having lived in Chicago, still running 2 businesses in the US and all the ecosystems that I have from Florida to Northern California, that it should be possible to support efficiently companies & organization’s from Germany (D), Austria (A), Switzerland (CH), what is known as the DACH, in their ambitions to build a footprint in some States of the Union.

That was the day Dach2US was born!

In the past 15 years in the capacity as General Manager, CEO, Founder or Advisor I worked intensely with 3 main approaches & methodologies:

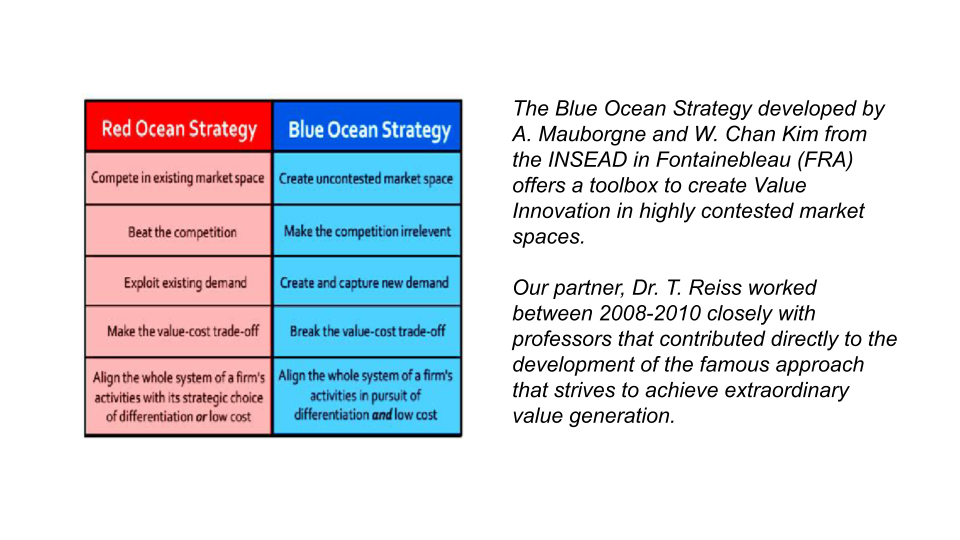

- Blue Ocean Strategy by Renée Mauborgne and W. Chan Kim

- Total Quality Management (TQM)/KAIZEN by Imai Masaaki

- Value Chain by Michael E. Porter.

With teams from Europe, LatAm & the USA we leveraged on these and created continuations, additional academic contributions and implementational procedures:

- Carati, Reiss Theorem©.

- Innovation-Operative© Mini-MBA.

- The Deep Blue Ecosys Strategy©.

- 30min-CEO-Method©

- Value Generation Consulting Group 360-Sphere-Analysis©.

So far I had the privilege to have been working in 23 countries where I worked predominantly in Greenfield & Expansion, Fast Growth, Turnaround. So Internationalization combined with the above Methodologies are at the core of my profession.

Today I like to pick the Blue Ocean Strategy in the context of Internationalization. I will build the case on an Austrian specialty product, as we call it internally a Curiosity-Product.

Introduction

The European Chocolate market is indeed highly competitive where countries alone carry the myth of producing the best confectioneries in the world. That alone is a major obstacle for an Austria based medium enterprise to compete efficiently in this Red Ocean.

Relevant efforts are necessary to keep your head above water such as special certifications, sophisticated branding & marketing, innovative packaging, precise pricing, smart sales & distribution.

As a smaller brand one competes with famous brand names and hundreds of millions of EUR in advertising budgets and massive access and market power with large retailers.

Smaller Chocolatiers also feel times of economic downturn faster and harder since most of them are positioned as a treat, a gift, a luxury indeed. These are the 1st expenses customers cut when the prognosed economic growth is zero (GER 2025) or negative (AUT 2025).

Between 2008 – 2010 I had the privilege to closely work with professors from the INSEAD in Fontainebleau, France, the cradle of the Blue Ocean Strategy approach.

So whenever there is talk about specialty consumer goods (FMCG), especially when associated with original denominations in the beautiful mountain ranges of the Alps, I love to pull out my footlocker and apply the Blue Ocean Strategy.

So lets start the Treasure Hunt and dive into the Expedition to find the Noncustomer, the uncontested market space and let’s venture the Escape from highly competitive environments …

The AS-IS analysis

Let’s have a look at the current market situation for said Schokoladen-Manufaktur and the key characteristics of the competitive environment in the high end Bonbonniere market.

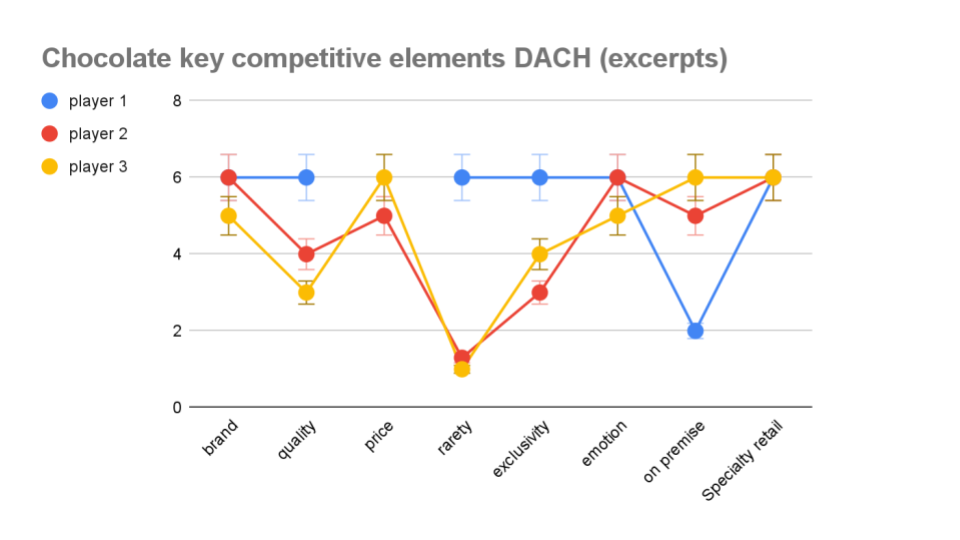

Our analysis shows that there is very little differentiation between DACH chocolate producers’ offerings. Only player 1 shows a distinguished strategy driven by rarity and exclusivity but that is also due to the size of our client compared with the other 2 examples here which are industrial size producers of high quality products.

Nevertheless all 3 compete with similar outbound strategies and in the DACH are positioned equally from the customers perspective.

Otherwise all of the companies are competing on the same criteria. The 2 competitors in our excerpt are already heavily exporting across the globe.

Brand: Player 2-3 are well established brands, known by most consumers of the Praline like category. Therefore it’s a relevant challenge for our client to compete in this field.

- How to make the consumer purchase the unknown vs the well known?

- Define and find the noncustomer.

Quality: Also our client offers by far the highest quality because A) it’s a Manufacture, B) it’s products are organic & EMAS certified it is a major challenge to compete with large marketing budgets.

Price: In the DACH market the pricing of all 3 examples is a major competitive factor and consumers are highly responsive to price changes. So we see a relevant negative price elasticity.

Rarity: Indeed due to the mentioned production capabilities, Manufacture vs Industrial, player1 is a much more exclusive producer but it’s difficult to turn this into an economically viable communication strategy.

Exclusivity: Player1 is very exclusive and Connoisseur-Style but that turns almost in a disadvantage in the DACH since player 2-3 are omni-present. Chocolate- & Praline Aficionados preferences are difficult to target in the DACH competitive environment.

Emotion: All 3 players strongly work on the emotions of the potential buyers also through exclusive packaging, special occasion promotions and specific innovative product design.

On-Premise Players 2-3 are much better positioned in large retail outlets due to their financial and market power.

Specialty retail: All 3 players go also through specialized retailers which annihilates the competitive advantages of a niche producer with relevant certifications like Organic & EMAS

Analyzing the customer motivation to buy player1 and the related factors that influence the buyers decision, confirmed again the challenges that our client faces in the existing, traditional markets: It looks like it’s all about the bloody price, brand presence and brand emotion and therefore, it’s a bloody Red Ocean where the Big eats the small.

Continuing our research we further looked into customers that purchase presumably interchangeable product categories. Let’s also not forget that the Bonbonnieres compete further with other feel good products like on occasion flowers, spirits and other Feel-Good merchandise. Choices are often random and availability driven. Yet another disadvantage for a small Manufacture.

Furthermore there is low consumer awareness regarding the production processi or the differences in quality between the 3 examples, nevertheless the closely related Family Traditions.

When asked, the respondents indeed knew the player 2-3. Player1 is therefore more a destination brand only to market with strong financial efforts in branding & marketing.

So our next field of investigation was to understand what people do not like about high end Chocolates and why it is in their perception very interchangeable.

- Big brand names that emanate quality are overwhelming the smaller producers.

- ‘I rather buy a known brand than risk making a gift of a no-name and to disappoint friends’.

- Not Availability.

- Higher Price.

- People don’t know enough about different qualities.

- All 3 players are the same.

Buyers Utility Map and Strategy Regeneration

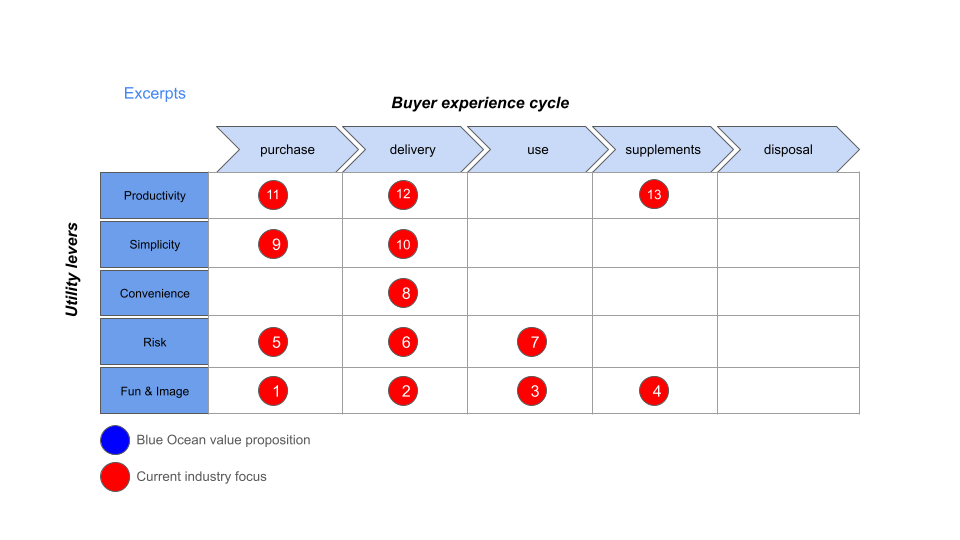

By building the Buyers Utility Map we achieve a better understanding of what makes chocolate & praline lovers not purchase player1’s product and what could be potential fields of improvement By doing so we gain a better understanding of the roadblocks to be removed to make nonbuyers to become aficionados.

- ‘Omni’ availability vs small production.

- Innovative packaging.

- Product Combos.

- Special Promotions.

- Branding overwrites quality & exclusivity.

- On premise positioning.

- On premise marketing.

- Destination product.

- Online ordering driven by marketing budget.

- Similar pricing.

- Missing professional advice due to unaware or not existing staff at large retailers.

- Cross promotion potential.

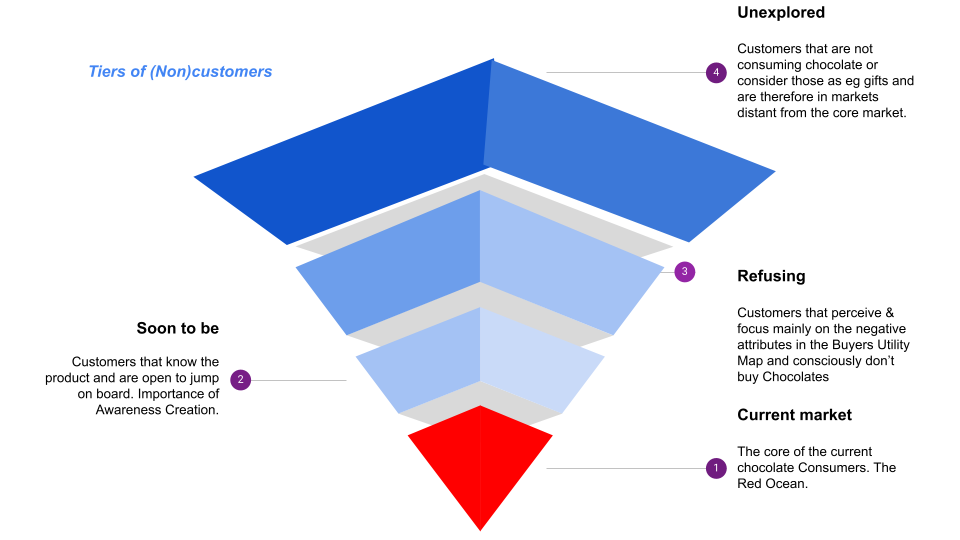

Understanding the non-customers helps profiling them and therefore to make one understand where adjustments to the current value proposition should be made to be able to reach out to them and to make them connoisseurs.

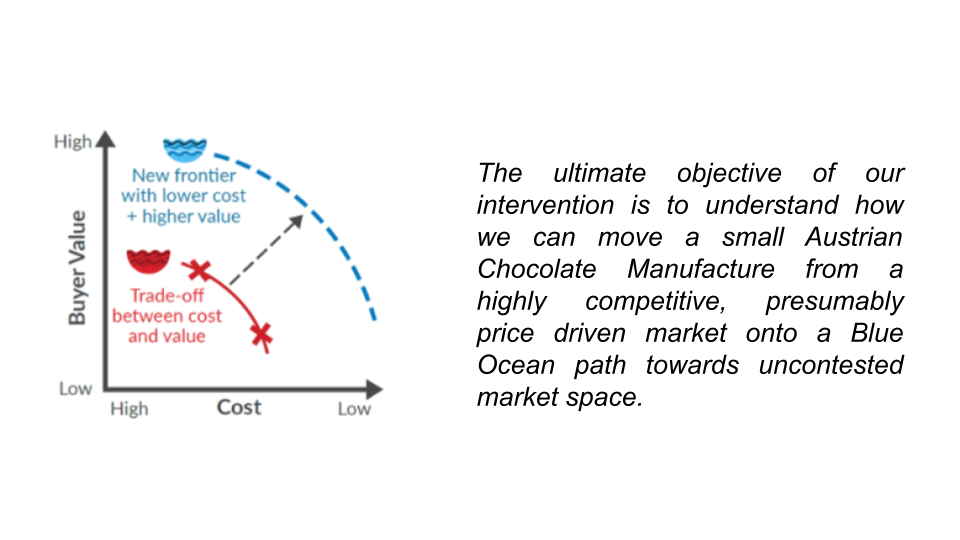

By doing so, latent demand is unveiled away from the traditional Red Ocean and “unlimited” market space is discoverable.

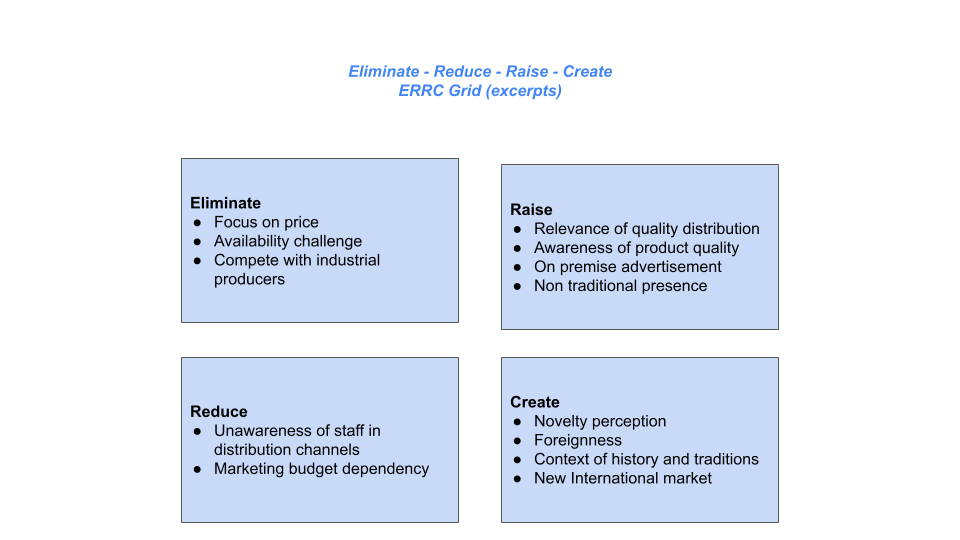

Once the Byers Utility Map and the Tiers of (Non)customres are explored we apply the ERRC Grid to pursue the differentiation regarding the traditional market and hereby to break the value-price-trade-off. Ideally the segments Eliminate and Reduce also lead to a reduction in internal costs related to the production and distribution of high quality Chocolates.

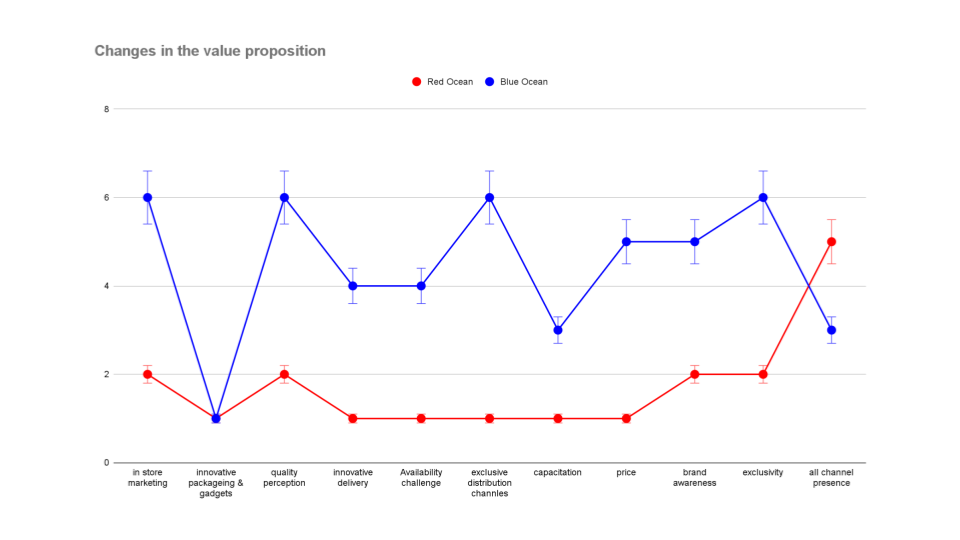

Based on the learnings through a thorough analysis it is possible to define a new, a Blue Ocean value proposition that taps into the uncontested market space. In our case one solution is to enter the US-market.

Conclusions

What might seem at 1st a simplistic solution has a wider perspective.

- When done right even a SME can consider entering the US market in the correct context.

- Efficient use of internal and external resources by limiting the time & financials spent on the expansion.

- Tariffs and export costs might not play a relevant role if the expected margins are multiples of the margins in the DACH.

- Player 2-3 are already present in the US but there they follow a price driven competition matrix and they position themselves among US-quality producers and as mass products.

- US consumer behaivior is attracted by quality products from the Alpine regions of the DACH.

- Smart branding & marketing can make the difference.

- Smart distribution and intelligent growth strategies keep costs low.

- US consumption indicators & the vastness of the market speak in favor to take the opportunity to expand and diversify across the Atlantik.

The main learnings in the Florida, Chicago and San Fran context are:

- In phase1 the focus needs to be on brand and quality awareness.

- Boutique products need boutique distribution including quality sales staff, street teams and on-premise presence for sales activation deployments, as well as customized branding & marketing strategies.

- BOOTS ON THE GROUND is KEY.

- The novelty and exclusivity aspect is a field that needs emphasis.

- To align Outbound activities with Inbound needs like logistics, warehousing and strategic stocks is fundamental to control costs.

Blue Ocean Strategies are always worth pursuing!

Michael Hofmayer is co-founder of the Dach2US portal and the portals mission to facilitate Transatlantic business relations. He is a seasoned system architect, administrator, and software developer with over two decades of experience delivering innovative ICT solutions for industries like finance, e-learning, and technology.

As an entrepreneur, Michael excels in aligning technical solutions with business objectives, ensuring his projects—such as automated financial advisory platforms and e-learning systems—meet operational needs and strategic goals, seeking impactful, scalable ICT systems.

Dr. Torsten Reiss is co-founder of Dach2US. He graduated from the Universa’ degli study di Bologna, the oldest University in the world and after he started his career as Investment Banker for Deutsche Bank. Later he worked for many years in Strategy- & Management consulting in countries such as Germany, Italy, Poland, the UK and several countries in LatAm before returning to deliver concepts for the PE and M&A industry.

In recent years TR gained in-depth insights into the world of Technology- & Business Model Innovation working with start- & scaleups. He has a strong academic record teaching as guest and working on case studies with some of the top 10 MBA schools worldwide and to end up developing a MiniMBA together with some renowned professores from Universties like UC Berkeley, MIT and IEEE.

As entrepreneur and executive TR was involved in more then 40 company launches and Internationalization projects on 3 continents.

Leave a Reply

You must be logged in to post a comment.