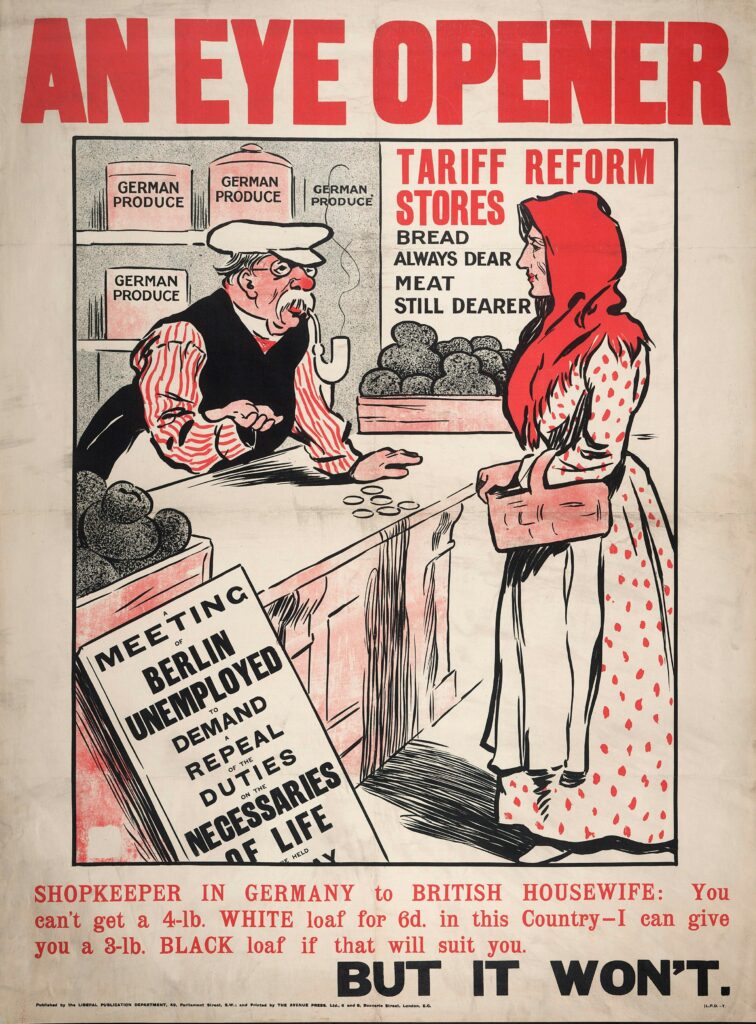

Trade wars all the rage!

In the presence of increasing trade tensions between the USA and the EU there might also be opportunity for companies that already in the past did consider to expand distribution or operations to the US or that are looking into joint ventures. The US are always a very attractive market also due to the sheer size of consumption and the truly single market economy.

Having an outpost in an US-State makes also sense from the prospective to be close to the culture, as well to have exposure to the worlds strongest Technology Innovation ecosystem.

At the other hand it is also always advisable to have a deeper look into the segments of products & services which are hit by tariffs and to design accordingly, corresponding solutions.

But what counts in one direction even more so is true in the other. The EU is a very, even so complex, market where customer loyalty is strong and many US products are highly appreciated.

It’s not only about getting the product or service there

Importing goods from Germany, Austria, and Switzerland to the USA involves navigating various regulations and procedures. This guide will walk you through the fundamentals, including legal requirements, documentation, and logistical considerations, ensuring a smooth import process.

But more then anything it is important to choose the best US-States as entry points for ones base since importation is just the 1st step. Many states have no personal income tax, low sales taxes and differ in corporate taxes.

Other important factors are the availability of an educated workforce or for example the existence of a strong Innovation ecosystem.

It is always good to keep in mind that some states GDP is larger than most EU countries’ whole economy.

Furthermore to pick the right distributors, wholesalers and to choose the best fitting joint venture partner can be decisive in succeeding in this vast and very capitalistic market.

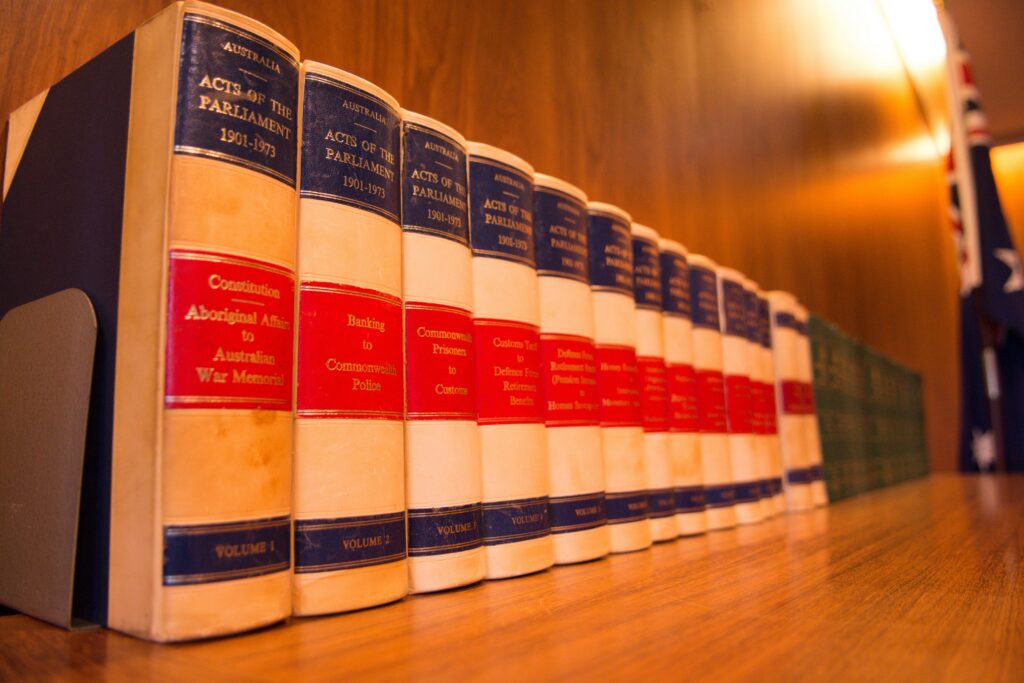

Legal Requirements and Documentation

When importing from Germany, Austria, and Switzerland to the USA, it’s crucial to understand the legal framework and necessary documentation. The key documents include:

- Commercial Invoice: This document is essential for customs clearance and includes details such as the seller, buyer, goods description, quantity, value, and terms of sale.

- Packing List: A detailed list of the contents of the shipment, including weights, measurements, and packaging details.

- Bill of Lading: A legal document issued by a carrier to acknowledge receipt of cargo for shipment.

- Certificate of Origin: This document certifies the country of manufacture and is often required for customs purposes.

Additionally, ensure compliance with U.S. Customs and Border Protection (CBP) regulations and import duties. Depending on the type of goods, you may also need to adhere to specific regulations from agencies like the FDA, USDA, or EPA.

Logistical Considerations and Best Practices

Efficient logistics are vital for a successful import process. Key considerations include:

- Choosing a Freight Forwarder: A reliable freight forwarder can handle the complexities of international shipping, including customs clearance, documentation, and transportation.

- Transportation Modes: Decide on the most suitable mode of transportation—air, sea, or land—based on the nature of the goods, urgency, and cost.

- Insurance: Protect your investment with cargo insurance to cover potential losses or damages during transit.

- Compliance with U.S. Regulations: Ensure that all imported goods comply with U.S. regulations, including safety standards, labeling requirements, and licensing.

Implementing best practices, such as thorough documentation, timely communication, and working with experienced partners, can streamline the import process and minimize delays and costs.

Customs Procedures and Tariffs

Understanding customs procedures and tariffs is essential for a smooth import process. Key points include:

- Harmonized Tariff Schedule (HTS): Determine the HTS code for your goods to classify them correctly and calculate applicable duties.

- Customs Duties and Taxes: Be aware of the duties and taxes that will be levied on your imports. This includes ad valorem duties, specific duties, and additional taxes like the Merchandise Processing Fee (MPF).

- Customs Clearance: Ensure that all necessary documents are submitted to customs authorities for clearance. This process can be facilitated by a customs broker.

Staying informed about customs procedures and tariffs can help you plan your import budget and avoid unexpected costs.

In conclusion, importing from Germany, Austria, and Switzerland to the USA involves meticulous planning and compliance with various regulations. By understanding the legal requirements, documentation, logistical considerations, and customs procedures, you can ensure a successful and efficient import process. Proper preparation and collaboration with experienced partners like Dach2US will help you navigate the complexities and achieve your import goals.

About the author

Michael Hofmayer is co-founder of the Dach2US portal and the portals mission to facilitate Transatlantic business relations. He is a seasoned system architect, administrator, and software developer with over two decades of experience delivering innovative ICT solutions for industries like finance, e-learning, and technology.

As an entrepreneur, Michael excels in aligning technical solutions with business objectives, ensuring his projects—such as automated financial advisory platforms and e-learning systems—meet operational needs and strategic goals, seeking impactful, scalable ICT systems.

Leave a Reply

You must be logged in to post a comment.